Innovative Financing Calculator: Equipping Your Budgeting Methods

Its influence goes beyond mere mathematical computations; it plays a crucial role in monitoring one's monetary health and, ultimately, in maximizing budgeting techniques. This device's potential to transform the way people browse their financial landscape is undeniable, supplying a look into a realm where budgeting ends up being even more than simply number crunching.

Comprehending Funding Options

When considering obtaining cash, it is vital to have a clear understanding of the various funding alternatives readily available to make educated financial choices. One common kind of loan is a fixed-rate lending, where the rate of interest remains the same throughout the lending term, offering predictability in regular monthly repayments. On the various other hand, adjustable-rate fundings have rates of interest that change based on market problems, providing the potential for reduced initial prices but with the threat of raised settlements in the future.

One more option is a guaranteed car loan, which calls for security such as a home or cars and truck to secure the borrowed amount. This sort of car loan normally supplies lower rates of interest because of the lowered danger for the lending institution. Unsafe finances, however, do not need security yet commonly included greater rates of interest to compensate for the boosted risk to the lender.

Recognizing these lending options is vital in selecting the most ideal financing solution based upon monetary circumstances and individual demands. home loan calculator. By considering the benefits and drawbacks of each kind of financing, borrowers can make knowledgeable decisions that align with their lasting economic objectives

Computing Settlement Routines

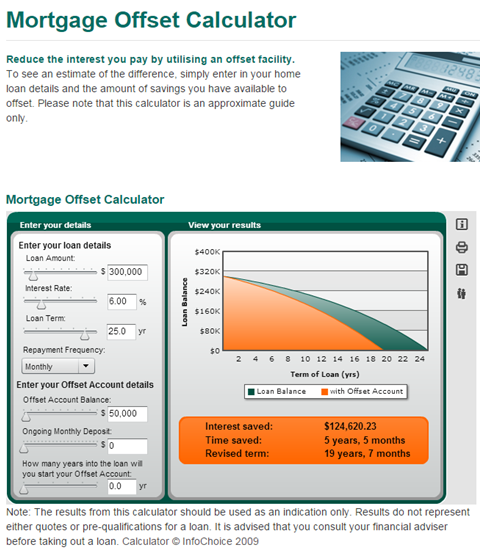

To properly handle financing payment obligations, understanding and precisely computing payment schedules is paramount for keeping financial security. Computing settlement timetables involves determining the amount to be paid back regularly, the regularity of settlements, and the total period of the financing. By damaging down the complete funding amount into convenient periodic settlements, customers can budget plan effectively and make certain prompt payments, hence avoiding late charges or defaults.

There are different techniques to compute payment timetables, including making use of funding amortization timetables or on the internet finance calculators. Loan amortization routines supply an in-depth malfunction of each payment, demonstrating how much of it goes in the direction of the major quantity and how much towards interest. Online finance calculators streamline this process by allowing individuals to input car loan information such as the principal amount, rates of interest, and financing term, generating a settlement timetable immediately.

Understanding and calculating payment routines not only aid in budgeting but also offer consumers with a clear introduction of their economic commitments, allowing them to remain and make educated decisions on course with their payment commitments.

Monitoring Financial Health

Keeping an eye on financial wellness includes on a regular basis evaluating and examining one's financial condition to make sure stability and educated decision-making. By keeping a close eye on essential financial signs, individuals can determine potential concerns early on and take proactive procedures to address them.

Furthermore, keeping an eye on financial savings and investments is crucial for lasting financial health. Regularly evaluating investment portfolios, pension, and reserve can aid individuals gauge their development towards meeting monetary goals and make any type of necessary modifications to optimize returns. Checking financial debt degrees and credit rating is additionally crucial in analyzing total economic click here to find out more health. Tracking debt equilibriums, passion prices, and credit rating use can assist individuals handle financial debt effectively and preserve a healthy credit rating profile.

Making Best Use Of Budgeting Methods

In optimizing budgeting methods, people can take advantage of numerous techniques to enhance monetary preparation and source allowance successfully. One secret technique to take full advantage of budgeting approaches is with establishing clear monetary goals.

Additionally, focusing on cost savings and financial investments in the spending plan can help people protect their economic future. By allocating a part of revenue in the direction of financial savings or retired life accounts prior to various other expenses, people can build a safety and security web and work towards long-term economic stability. Looking for specialist guidance from economic coordinators or consultants can also assist in making the most of budgeting strategies by obtaining tailored guidance and know-how. Generally, by using these strategies and staying disciplined in budget plan administration, people can other efficiently optimize their financial sources and achieve their monetary objectives.

Using User-Friendly Features

Final Thought

Finally, the cutting-edge lending calculator provides a valuable device for people to recognize car loan choices, calculate payment timetables, display financial wellness, and take full advantage of budgeting approaches. With straightforward features, this device empowers individuals to make informed monetary choices and prepare for their future financial goals. By making use of the finance calculator efficiently, people can take click over here control of their financial resources and accomplish better economic security.

Keeping track of monetary wellness includes on a regular basis examining and assessing one's monetary standing to make certain security and educated decision-making. Generally, by employing these techniques and staying disciplined in spending plan management, individuals can successfully maximize their financial resources and accomplish their economic objectives.

In conclusion, the cutting-edge funding calculator uses a valuable device for individuals to recognize car loan alternatives, determine settlement routines, display financial health, and make the most of budgeting methods. With user-friendly functions, this device encourages users to make enlightened monetary choices and strategy for their future monetary goals. By utilizing the finance calculator successfully, people can take control of their finances and achieve better economic stability.